Pay In 3

What is PayPal Pay in 3?

PayPal Pay in 3 is an interest-free loan that lets you split your basket into 3 payments, with the first due at time of purchase and subsequent payments due every month on the same date.

It’s a great way to spread the cost of larger items or to cover emergencies, and is a helpful tool to manage your budget more effectively.

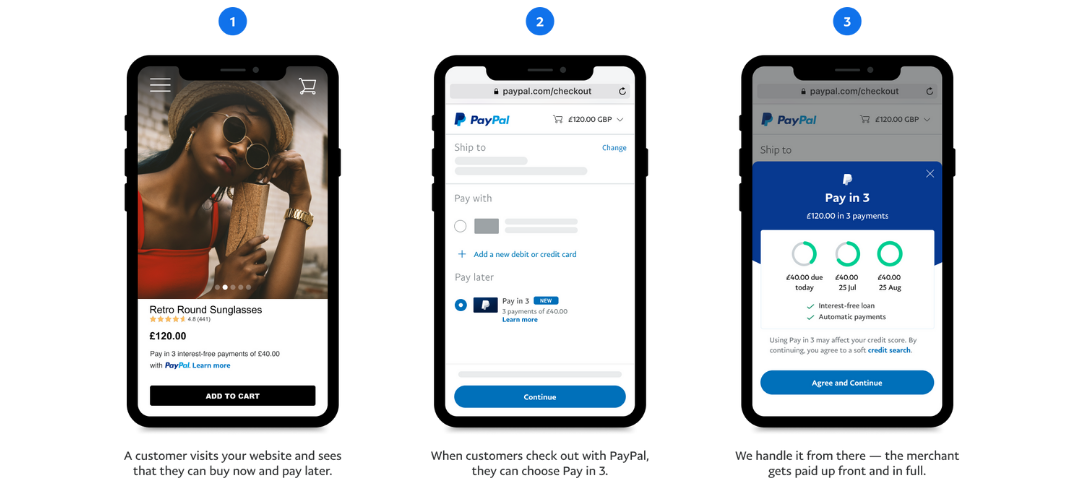

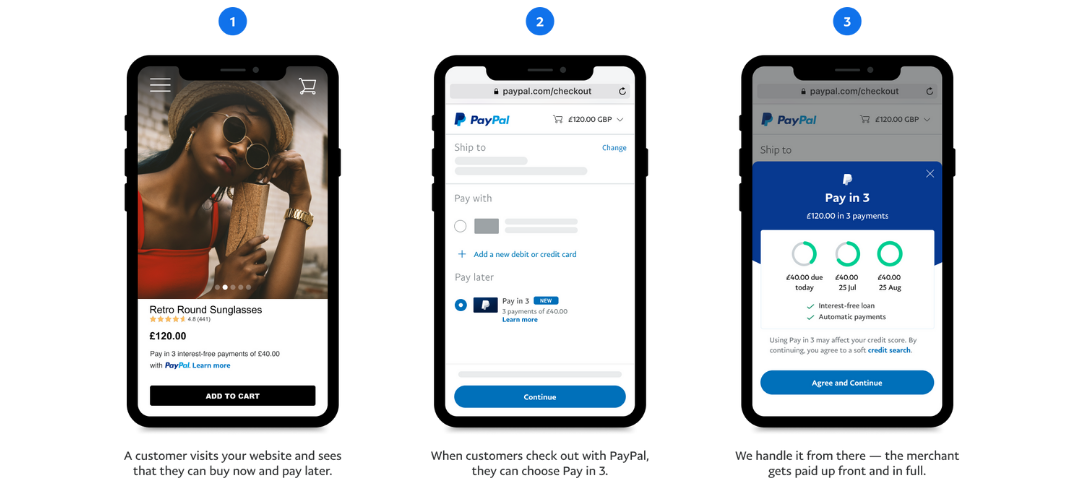

How Does It Work?

When you select PayPal Pay in 3 at checkout, you'll be able to split your purchase into three instalments. There's no interest, fees, or impact on your credit score, making it a convenient and budget-friendly way to pay for your purchases.

Key Features:

- Budget-friendly: Spread the cost of your purchase over three payments, making it easier to manage your budget.

- No Interest: Enjoy the convenience of splitting your payment without incurring any interest charges.

- Quick Approval: There's no need for a credit check, and approval is instant, so you can complete your purchase without delay.

- Secure Transactions: Benefit from PayPal's secure payment platform, ensuring that your transactions are safe and protected.

Pay In 3

BUY NOW. PAY OVER TIME

Time and flexibility are on your side. Manage your budget and break the payments up over 2 months.

Make the first payment at the time of purchase and make two more payments on the same date each month. Split your purchases of between £30 and £2,000 into 3 interest-free payments without late fees.

How to Use:

Using PayPal Pay in 3 is simple. Just select it as your payment option at checkout, and if eligible, you'll be able to split your purchase into three payments. The first payment will be due at the time of purchase, with the remaining two payments automatically deducted from your chosen payment method every two weeks.

Important Considerations:

- Make sure you have sufficient funds in your account for each instalment payment to avoid any issues.

- Keep track of your payment schedule to ensure timely payments and avoid late fees.

Do I Have To Pay PayPal Fees?

No, with PayPal Pay in 3, you do not pay fees associated with PayPal Credit. PayPal Pay in 3 is a separate service that allows you to split your purchase into three equal payments, with the first payment due at the time of purchase and subsequent payments scheduled every two weeks. There are typically no fees or interest charges associated with PayPal Pay in 3, making it a convenient and cost-effective option for budgeting your purchases.

FAQ'S

PayPal Pay in 3 is an interest-free loan that lets you split your basket into 3 payments, with the first due at time of purchase and subsequent payments due every month on the same date.

It’s a great way to spread the cost of larger items or to cover emergencies, and is a helpful tool to manage your budget more effectively.

Please note that Pay in 3 is a form of credit, so carefully consider whether you can afford the repayments and be aware of the possible impact of missing payments, including making other borrowing more difficult or more expensive.

We’re offering PayPal Pay in 3 to a growing number of our UK customers.

PayPal Pay in 3 is not available for certain merchants and goods. We may also decide not to offer PayPal Pay in 3 as a payment option in certain circumstances, such as where our checks suggest an increased risk of fraud or where data we hold suggests you may not be eligible. The checks we run are with an external credit reference agency. This search will only be visible to you and will not affect your credit score.

If you choose PayPal Pay in 3 as your payment method when you check out with PayPal, you’ll be taken through the application process. You’ll get a decision instantly, but not everyone is approved based on the checks we carry out.

When applying for a PayPal Pay in 3, we may conduct a “soft” credit check if we need more information to make a decision. “Soft” credit checks are not visible to others, so have no impact on your credit file. However, we do share some data on your repayment history with Transunion. Although it does not impact your credit score, this data will be visible to other companies and may impact your ability to obtain credit from other lenders and the cost of accessing it. More information is available in our Pay in 3 Terms & Conditions.

Your plan will last 2 months in total. The first payment will be due at the time of purchase, followed by 2 further payments due each month after that.

To apply for PayPal Pay in 3, you’ll need to provide your:

- Title

- Phone number

- Address

- Date of birth

- Payment details

Our decision making process is automated. We assess your financial position using a combination of the information you provided within your application, and information about your usage and history with PayPal to decide whether PayPal Pay in 3 is suitable for you at this time. We may also run a “soft” credit check with an external credit reference agency when you apply if we need more information to make our decision. This search will only be visible to you and will not affect your credit score.

There are no fees for choosing to pay with PayPal Pay in 3.

IF you have more questions about PayPal's Pay In 3 then check out their website here

Ready to gain your freedom?

Shop our folding mobility scooters here